How To Accept Credit Card Payments as a Freelancer

As a beginner freelancer, you might be wondering how clients can easily pay you online. Credit cards are one of the most common ways for clients and companies to pay their freelancers – so we’re going to run through how to accept credit card payments as a freelancer to ensure you get paid faster!

The first step towards being paid quickly as a freelancer is accepting a range of different types of payments.

Customers can make payments in various methods, including whipping out their credit cards. It might seem difficult for you as an individual to accept credit cards as payment – but it doesn’t have to be!

Freelancers are redefining the workforce, with over 70 million in the US alone. Additionally, their numbers have only increased since the pandemic started. Software and financial companies have responded by allowing individuals and small businesses to get paid easily with their apps and software.

Accepting Credit Card Payments

Credit cards may be the best payment method for freelancers and customers if time and convenience are crucial elements for you. Credit card transactions are speedy, secure, and easy to record. Many clients use business credit cards, which makes things much easier.

Clients may frequently request payment by credit card, mainly if you’re working on expensive, lengthy projects like copywriting assignments. The client might need to charge it since they don’t have a significant amount on hand.

So how do I accept credit card customers? Accepting card payments necessitates using a payment service provider (PSP). Some choices, such as Paypal, Venmo, and virtual wallets, can fill this role. This is terrific since processing cards used to require the purchase of bulky credit-card reader equipment or cash registers.

If you’re going to be accepting credit card payments, you’ll probably need the appropriate hardware. Fortunately, technological advancements have made it a breeze. A credit card reader and payment system may be purchased at a low price in many cases. If you need to process a client’s card physically, you can use the reader attached to a smartphone.

Fortunately, there are virtual suppliers accessible today, such as Stripe and Wise. What’s the catch? Credit card processors also charge fees. Sure, they’re small fees, but everything adds up when you’re a freelancer!

Ensure you’re getting the best charge rate possible, and the lowest fees – and remember to add in a credit card processing fee to your project proposals so you’re not paying these fees out of your own pocket.

How To Accept Credit Card Payments as a Freelancer

Stripe, an innovative online payment platform, has simplified online purchases. Stripe is a credit card and online payment system for eCommerce and other companies.

Paypal

PayPal is one a preferred mode of payment for many freelancers, since it can handle all types of payments, including credit card transactions.

You may start sending invoices for payments by opening either a business or a personal account. Even while it is possible to do so with a personal account, I believe that having a PayPal business account simplifies the process of requesting money.

To facilitate the processing of money transfers using credit cards, PayPal imposes a fee of 2.9 percent in addition to a flat cost of 30 cents. This information may come as a surprise to you. Therefore, if a client wants to pay a freelancer $100, they should be prepared to pay an additional $3.20.

Venmo

It may seem like an app that college students use to transfer money to one another, but Venmo is so much more than that. Venmo has been an excellent option for receiving payments from many of my customers, and I often use it.

The app works without a hitch, but you and your customer both need to install the Venmo app to send and receive money. This isn’t the same as PayPal, where customers may pay an invoice even if they do not have the PayPal app. As a result, the online accounting process for customers is simplified.

Venmo is a great option if you have a customer willing to pay using the service. For customers, Venmo charges a three percent fee for using a credit card to transfer money.

Cash App

Cash App comes up next. Although this app may seem the least professional, it has many valuable features and functions for its users. The versatility of the Cash App extends to the purchasing of stocks and cryptocurrencies as well as the transfer of money via credit cards. It is now the best money app that can be found in the App Store.

Like Venmo, it also requires that both parties download the application before they can begin sending and receiving money from one another. However, after you’ve downloaded it, the next steps are simple.

Freelancers can register an account and provide their $Cashtag to clients, who can subsequently process payments to the freelancers using their credit cards. Customers using Cash App are subject to a transaction charge of three percent of the total amount.

Stripe

Stripe allows you to collect payments from clients using various standard payment methods, including credit cards. As a freelancer, you can sign up for a free account, and generate invoices for your clients within the platform – allowing your clients to pay quickly and securely with credit card. It’s that simple!

Stripe doesn’t have a lengthy underwriting procedure in place. You can start using Stripe immediately and without hassle or delay. Stripe charges 2.9 percent + $0.30 for each successful online transaction for its services. This applies to both regular credit cards and digital wallet transactions.

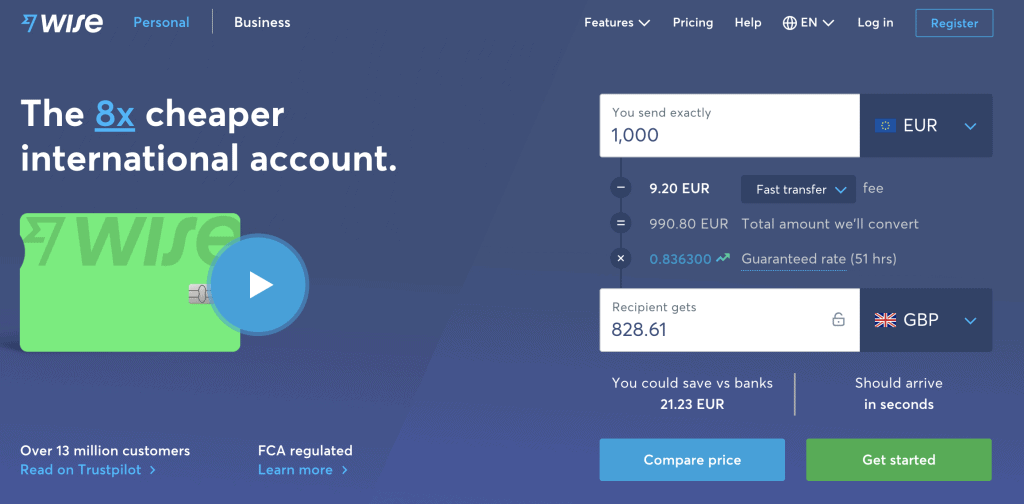

Wise

Wise’s approach to transferring funds to your bank account is quick and straightforward – and it has the lowest fees out of all the payment processors we’ve mentioned. It’s my absolute preferred method of getting paid by credit card.

Just tell the sender your bank’s information. You will be paid immediately into your bank account in the currency of your choice.

When receiving money from another country via a conventional bank, the expenses associated with the transfer are usually paid for by the person sending you the money. In addition, you did not get the total amount you anticipated since certain expenses were involved.

However, when you use Wise, your account will have no fees deducted from the remaining amount. This is one of the most significant benefits that Wise offers.

How To Accept Online Payments With Credit Cards Using Invoicing Software

Perhaps, you ask: is there an app that allows me to receive credit card payments, and also send invoices, contracts, and proposals to clients?

The good news is yes – as a freelancer, you can make life easier creating, sending, and tracking bills and accepting payments with the help of special freelancing software.

Tools for accounting, project management, customer relationship management, and productivity are often included in the majority of these systems in addition to their primary function.

Since all these systems are hosted in the cloud, they all come equipped with powerful mobile applications that allow you to submit invoices away from your desk.

- Wave – Wave offers an invoicing solution for freelancers looking to simplify and automate their basic invoicing requirements. Additionally, Wave Invoicing is entirely free of charge.

- Hello Bonsai – Hello Bonsai is your solution if you search for a highly integrated, all-in-one platform created exclusively for freelancers to handle their projects. You can read more about using Bonsai as a freelancer here.

- FreshBooks – FreshBooks is one of the most well-known accounting software suppliers available today. It is a favorite among businesses of all sizes as well as people who are self-employed.

- Square Invoices – Square Invoices is the most basic and uncomplicated option on the list and a perfect alternative for those looking for simple but trustworthy invoicing software.

- HoneyBook – HoneyBook is an all-in-one client and project management software for small enterprises and freelancers.

In Summary – How To Accept Credit Card Payments as a Freelancer

That’s our guide to how to accept credit card payments as a freelancer.

Whenever a customer wishes to pay with a credit card, freelancers should let them know that there will be an extra cost to do so – but that there are still other options they can use such as sending a wire transfer or bank transfer, if they don’t want to pay an additional percentage for using their credit card.

Your chances of getting paid quickly increase if you’re prepared to adapt to the payment preferences of your clients – and for the majority of clients, paying with their credit card is the easiest option.

![31 Best Books For Freelance Copywriters [2023]](https://mightyfreelancer.com/wp-content/uploads/2021/06/thought-catalog-nbkd_9UpSb0-unsplash-768x513.jpg)